Unlock financial freedom with Liberty1 Financial’s latest offering – introducing new low APR loans, your pathway to affordable and flexible financing solutions.

How Much Money Do You Need to Buy a House?

Things You Should Know!

- The down payment is not the only upfront cost when buying a house.

- The upfront costs of buying a home will vary for everyone and will most likely rely on the type of mortgage, value of the home, and where the home is.

- Every house has a price tag, but there is much more to the cost of buying a home.

Example:

If you were to buy a $300,000 house with 20% down, you would need the following upfront…

- $60,000 down payment (20%)

- $18,000 closing costs (6%)

- $2,471 initial annual property tax (average amount of property tax in the US)

- $1,300 initial Homeowners Insurance cost (average cost in the US)

$81,771 = Total out of pocket cost to purchase a $300,000 house.

Having all of this in mind when purchasing a house is very important and being prepared for every expense should be taken into consideration.

1. Down Payment

The down payment is the initial payment you would contribute toward the total of your home’s price. Putting at least 20% down on your home will increase your chances of receiving a better mortgage rate. 20% is considered the traditional down payment amount for a house. If you cannot make the 20% down payment then you may be able to receive a loan with less money upfront, but then you may face a higher interest fee and higher monthly payments.

2. Closing Costs

Closing costs are the lender and third-party fees paid at the closing of a real estate transaction. When closing on a house, you can expect to pay taxes, appraisals, title cost, attorney fees, etc. This all comes out to generally between 3% and 6% of your mortgage principle. Your mortgage principal is the amount you borrow after your down payment is made.

3. Mortgage Payment

It is important to always calculate how much your mortgage payment is going to be each month because this is a monthly payment and not just a one-time fee. Your mortgage payment is one of the most predictable costs in buying a house.

Your mortgage rate has a large impact on your mortgage payment. According to studies, more than 3 out of 4 home buyers only applied for a mortgage with one single lender and did not shop around to find the best rate. In addition to paying interest and principal, your mortgage payment will likely be including mortgage insurance when you do not put 20%+ down.

4. Property Taxes

Property taxes are usually paid bi-yearly, and it is a tax on the purchase value of the property. This tax is paid when you own a home in a state that charges it. Property taxes vary by state and county. Having a good idea of what your property taxes are going to be when buying a house is important.

Local governments can vary property taxes by raising them for covering county expenses therefore do not expect your property taxes to always stay consistent.

5. Homeowners & Hazard Insurance

Homeowners and hazard insurance vary heavily on state and region where your house is located. The annual average for homeowner’s insurance is about $1,300, but again this all depends on the area of the home.

Hazard insurance is something that varies the most by location because it is based off of risk factor for disasters such as floods, earthquakes, tornados, etc.

6. Maintenance and Utilities

Once you think you have covered all the costs of buying a home, maintenance and utilities come in. Maintenance and repairs on a house will most likely be on-going for as long as the house is owned. Maintenance can be referred to around-the-house projects such as mowing the lawn, cleaning the carpet, or getting the gutters cleaned. Repairs can be referred to fixing anything that has broken around the house such as a broken sink.

Utilities will be ongoing daily living costs that are necessary. Utilities include electricity, water, gas, sewer, trash, internet, etc. These are all costs that are necessary to spend to live in a house comfortably.

Cost Overview

Overall, owning a home can have a lot of hidden costs. When you are thinking about purchasing a home, plan it out with every little detail to be facing no surprises down the road. Costs of a home can add up fast, make sure to do your homework and always try to receive the best rates on any aspect of buying a home because every dollar counts.

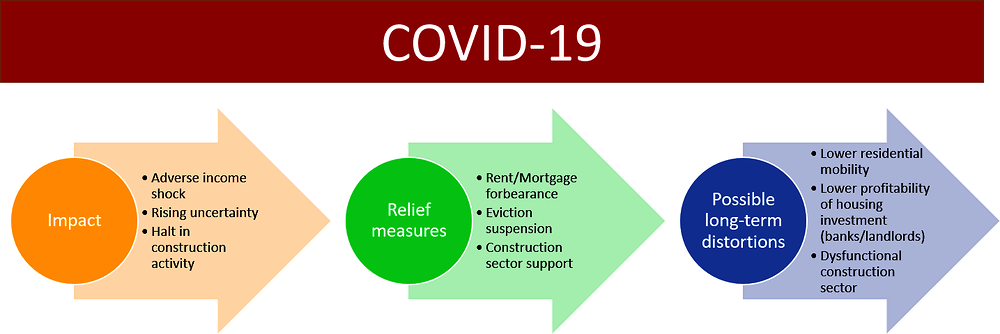

What Happens When Rent Forbearance Becomes Due?

Things You Should Know!

- In response to the COVID-19 Pandemic, the CARES ACT prohibits the eviction of nonpaying tenants and has recently extended it to end June 30th.

- At the time of June 30th, 2021 the amount that was not paid will be due IN FULL to the landlord.

- You are being charged no “extra” interest. Just the normal rent amount per month will have to be paid.

How Much Will I Owe My Landlord on June 30th?

You will owe your landlord any rent that was not paid due to forbearance. You will not have to pay any “extra” charges or late fees.

For example:

If your rent is $1,000 and you had not paid the past 3 month due to forbearance. You will owe your landlord $3,000 at the end of the forbearance period. The total will be the total rent added up to how many months were missed. Nothing more than that should be paid.

What Happens if you cannot pay the rent that has added up?

If the tenant cannot afford to make one payment to their landlord at the end of forbearance, they should discuss with their landlord beforehand to establish a payment plan that both sides are willing to agree too. It is prohibited for the landlord to require tenants to repay back rent in one lump sum without providing flexibilities.

Can I be Evicted on the Date the Forbearance Ends?

Property owners are not permitted to evict a tenant without a 30-day written notice. You will not be evicted without a 30 day notice therefore once you receive that notice you will have 30 days to vacate the property.

However, after the 30 day grace period, the landlord may move forward with eviction if a satisfactory repayment plan has not been agreed to by both parties.

Escape the Minimum Payment Cycle

When your goal is to get out of the constant cycle of credit card debt, it is NOT the best idea to keep paying the minimum payments.

Things You Should Know!

- Minimum payments are suggested specifically by credit card companies to keep you in a debt cycle that very few get out of.

- Try to find ways to put a little more toward your credit card debt every month to pay it down faster with less interest accumulating.

- Contact Liberty1 Financial to get a personal loan to pay off your debt with little to no interest!

Why Paying the Minimum Payment is a Massive Misconception?

When the end of the month rolls around, it is easy to pay the minimum payment and nothing more. This is exactly where your creditors want you to be, ultimately, they want you to prolong this cycle for as long as possible to get the most interest money as possible.

The minimum payment makes you think that you are making progress with paying down your debt, but the minimum payment is a constant cycle because the longer you stay in debt the more daily compounding interest you will pay on that amount.

The Best Way to Stay in Debt is to Abide by the Minimum Payments.

Most people do not realize the extra amount of money they pay by following the minimum payments.

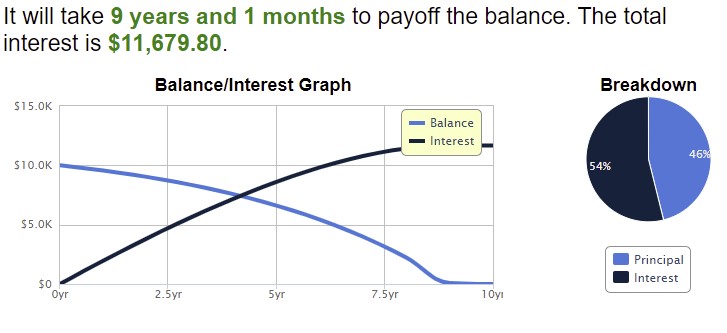

For Example: You have a credit card with a $10,000 balance, an interest rate of 20%, and a minimum payment of 2% (Payment would be $200).

Just by paying the minimum payments every month, it would take you 9 years and 1 month to payoff the balance. The total interest on that initial $10,000 would be $11,679.80.

Ultimately you would be paying a total of $21,679.80 over 9 years. Just for a $10,000 balance.

(Source: Calculator.net)

How to Pay More than the Minimum.

First and foremost, you must become aware that you are in a cycle that does not have a happy ending.

There are many solutions to fight against this hamster wheel.

- Figure out ways to put more than the minimum payment in every month. If this is a financial problem for you, then find a side gig that can make you a little bit more cash to put toward this payment.

- Use your resources such as Liberty1Financial.com to talk to an expert about how to work your way out of this and potentially get a personal loan with less interest than you are paying already.

How will Paying More than the Minimum Payments Help Financially?

The way that daily compounding interest works, you are most likely paying almost equal or more than your starting debt, just in total interest. Breaking this cycle and not letting the credit card companies pile you with interest every month will help you very much financially. Putting a little bit more every month or securing a personal loan with a low interest rate that does not compound is a solution for almost anyone in credit card debt.

Do NOT get stuck in that never ending cycle, break out of it and take back your financial freedom.

How long would it take to pay off your credit card debt by paying only minimum payments.

About 50% of all Americans have some kind of credit card debt, totaling in the 10’s of billions of dollars. With average interest rates at about 16% with some being above 29%, it is no wonder millions of Americans find it difficult to pay down their credit card debt.

The interest rate of a credit card is quite important as that determines how much you owe on the debt and eventually, how long it will take to pay. But the most important aspect in how long credit card debt takes to pay off is simply the amount you pay at the end of each month. Credit card companies have a monthly minimum payment requirement that allows you to amass large amount of debt while paying high interest rates for as long as possible.

Typically, the monthly minimum is $25 or in some cases, a small percentage and can range from 1%-3% of the balance and is the slowest way to pay off credit card debt. For example, let’s say you have $10,000 in credit card debt with an annual interest rate of 17% on the low end and every month, you pay the minimum balance of just $165.If you only pay the minimum balance of $165 per month for the duration of the debt, it would take you almost 12 years to pay off all of the debt. By the end, you would have paid just under $13,000 in interest alone on top of the original $10,000 you borrowed. If you double the payment to just $330, you could pay off all of the debt on the credit card in just 3 years and 4 months, paying a total of only $3,157 in interest.

Many people assume that paying the minimum requirement is enough to keep them ahead of their debt, but they do not take into account how long it will stretch the payment plan and how much interest they will incur over the course of the payment plan, as the example above shows. Paying as much as you can per month towards your credit card bill can vastly improve the debt situation by not only paying the debt off sooner, paying less in overall interest and fees, but by also helping strengthen your credit score.