Things You Should Know!

- The down payment is not the only upfront cost when buying a house.

- The upfront costs of buying a home will vary for everyone and will most likely rely on the type of mortgage, value of the home, and where the home is.

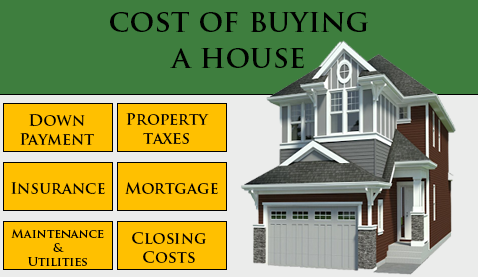

- Every house has a price tag, but there is much more to the cost of buying a home.

Example:

If you were to buy a $300,000 house with 20% down, you would need the following upfront…

- $60,000 down payment (20%)

- $18,000 closing costs (6%)

- $2,471 initial annual property tax (average amount of property tax in the US)

- $1,300 initial Homeowners Insurance cost (average cost in the US)

$81,771 = Total out of pocket cost to purchase a $300,000 house.

Having all of this in mind when purchasing a house is very important and being prepared for every expense should be taken into consideration.

1. Down Payment

The down payment is the initial payment you would contribute toward the total of your home’s price. Putting at least 20% down on your home will increase your chances of receiving a better mortgage rate. 20% is considered the traditional down payment amount for a house. If you cannot make the 20% down payment then you may be able to receive a loan with less money upfront, but then you may face a higher interest fee and higher monthly payments.

2. Closing Costs

Closing costs are the lender and third-party fees paid at the closing of a real estate transaction. When closing on a house, you can expect to pay taxes, appraisals, title cost, attorney fees, etc. This all comes out to generally between 3% and 6% of your mortgage principle. Your mortgage principal is the amount you borrow after your down payment is made.

3. Mortgage Payment

It is important to always calculate how much your mortgage payment is going to be each month because this is a monthly payment and not just a one-time fee. Your mortgage payment is one of the most predictable costs in buying a house.

Your mortgage rate has a large impact on your mortgage payment. According to studies, more than 3 out of 4 home buyers only applied for a mortgage with one single lender and did not shop around to find the best rate. In addition to paying interest and principal, your mortgage payment will likely be including mortgage insurance when you do not put 20%+ down.

4. Property Taxes

Property taxes are usually paid bi-yearly, and it is a tax on the purchase value of the property. This tax is paid when you own a home in a state that charges it. Property taxes vary by state and county. Having a good idea of what your property taxes are going to be when buying a house is important.

Local governments can vary property taxes by raising them for covering county expenses therefore do not expect your property taxes to always stay consistent.

5. Homeowners & Hazard Insurance

Homeowners and hazard insurance vary heavily on state and region where your house is located. The annual average for homeowner’s insurance is about $1,300, but again this all depends on the area of the home.

Hazard insurance is something that varies the most by location because it is based off of risk factor for disasters such as floods, earthquakes, tornados, etc.

6. Maintenance and Utilities

Once you think you have covered all the costs of buying a home, maintenance and utilities come in. Maintenance and repairs on a house will most likely be on-going for as long as the house is owned. Maintenance can be referred to around-the-house projects such as mowing the lawn, cleaning the carpet, or getting the gutters cleaned. Repairs can be referred to fixing anything that has broken around the house such as a broken sink.

Utilities will be ongoing daily living costs that are necessary. Utilities include electricity, water, gas, sewer, trash, internet, etc. These are all costs that are necessary to spend to live in a house comfortably.

Cost Overview

Overall, owning a home can have a lot of hidden costs. When you are thinking about purchasing a home, plan it out with every little detail to be facing no surprises down the road. Costs of a home can add up fast, make sure to do your homework and always try to receive the best rates on any aspect of buying a home because every dollar counts.