When your goal is to get out of the constant cycle of credit card debt, it is NOT the best idea to keep paying the minimum payments.

Things You Should Know!

- Minimum payments are suggested specifically by credit card companies to keep you in a debt cycle that very few get out of.

- Try to find ways to put a little more toward your credit card debt every month to pay it down faster with less interest accumulating.

- Contact Liberty1 Financial to get a personal loan to pay off your debt with little to no interest!

Why Paying the Minimum Payment is a Massive Misconception?

When the end of the month rolls around, it is easy to pay the minimum payment and nothing more. This is exactly where your creditors want you to be, ultimately, they want you to prolong this cycle for as long as possible to get the most interest money as possible.

The minimum payment makes you think that you are making progress with paying down your debt, but the minimum payment is a constant cycle because the longer you stay in debt the more daily compounding interest you will pay on that amount.

The Best Way to Stay in Debt is to Abide by the Minimum Payments.

Most people do not realize the extra amount of money they pay by following the minimum payments.

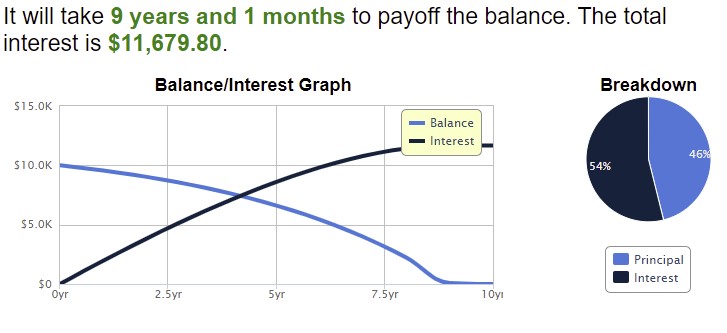

For Example: You have a credit card with a $10,000 balance, an interest rate of 20%, and a minimum payment of 2% (Payment would be $200).

Just by paying the minimum payments every month, it would take you 9 years and 1 month to payoff the balance. The total interest on that initial $10,000 would be $11,679.80.

Ultimately you would be paying a total of $21,679.80 over 9 years. Just for a $10,000 balance.

(Source: Calculator.net)

How to Pay More than the Minimum.

First and foremost, you must become aware that you are in a cycle that does not have a happy ending.

There are many solutions to fight against this hamster wheel.

- Figure out ways to put more than the minimum payment in every month. If this is a financial problem for you, then find a side gig that can make you a little bit more cash to put toward this payment.

- Use your resources such as Liberty1Financial.com to talk to an expert about how to work your way out of this and potentially get a personal loan with less interest than you are paying already.

How will Paying More than the Minimum Payments Help Financially?

The way that daily compounding interest works, you are most likely paying almost equal or more than your starting debt, just in total interest. Breaking this cycle and not letting the credit card companies pile you with interest every month will help you very much financially. Putting a little bit more every month or securing a personal loan with a low interest rate that does not compound is a solution for almost anyone in credit card debt.

Do NOT get stuck in that never ending cycle, break out of it and take back your financial freedom.